How to Make Money Every Day Trading Stocks

Trading stocks can be a lucrative way to make money, but it requires knowledge, discipline, and a solid strategy. Whether you’re a beginner or an experienced trader, there are several methods you can use to maximize your profits and minimize your risks. In this article, we’ll explore various approaches to help you make money every day trading stocks.

Understanding the Basics

Before diving into the strategies, it’s crucial to have a solid understanding of the stock market. Familiarize yourself with key terms like stocks, shares, market capitalization, and trading hours. Additionally, learn about different types of orders, such as market orders, limit orders, and stop-loss orders.

Developing a Trading Plan

A well-defined trading plan is essential for success. Determine your trading style, whether it’s short-term day trading, swing trading, or long-term investing. Set clear goals, risk tolerance, and profit targets. This will help you stay focused and disciplined throughout your trading journey.

Research and Analysis

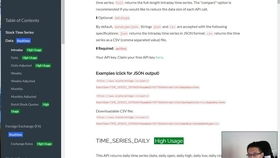

Successful trading relies heavily on research and analysis. Utilize various tools and resources to gather information about potential stocks. This includes financial statements, news, and technical analysis. Here are some key aspects to consider:

-

Financial Statements: Analyze the company’s income statement, balance sheet, and cash flow statement to assess its financial health.

-

News: Stay updated with the latest news and events that may impact the stock’s price.

-

Technical Analysis: Use charts and indicators to identify trends, patterns, and potential entry and exit points.

Implementing Strategies

Once you’ve gathered sufficient information, it’s time to implement your trading strategies. Here are some popular methods:

Day Trading

Day trading involves buying and selling stocks within the same trading day. This requires quick decision-making and a keen eye for market trends. Some popular day trading strategies include:

-

Scalping: Entering and exiting trades within a few minutes or seconds to capture small price movements.

-

News Trading: Reacting to significant news events that can cause sudden price movements.

-

Range Trading: Trading within a specific price range, taking advantage of price swings.

Swing Trading

Swing trading involves holding stocks for a few days to a few weeks, aiming to capture larger price movements. This strategy requires patience and a focus on long-term trends. Some popular swing trading strategies include:

-

Trend Following: Identifying and trading with the overall market trend.

-

Chart Patterns: Analyzing chart patterns, such as triangles, flags, and head and shoulders, to predict future price movements.

-

Volume Analysis: Using trading volume to confirm trends and identify potential reversals.

Long-Term Investing

Long-term investing involves holding stocks for an extended period, typically several years or more. This strategy requires patience and a focus on the company’s fundamentals. Some popular long-term investing strategies include:

-

Dividend Investing: Investing in companies with a strong track record of paying dividends.

-

Value Investing: Identifying undervalued stocks and holding them until they reach their intrinsic value.

-

Growth Investing: Investing in companies with high growth potential and strong fundamentals.

Managing Risks

Managing risks is crucial to ensure your trading success. Here are some key risk management strategies:

-

Stop-Loss Orders: Set a stop-loss order to limit your potential losses.

-

Position Sizing: Allocate a specific percentage of your trading capital to each trade.

-

diversification: Spread your investments across different sectors and asset classes to reduce risk.

Continuous Learning and Adaptation

The stock market is constantly evolving, so it’s essential to stay informed and adapt your strategies accordingly. Attend workshops, read books, and follow successful traders to gain insights and improve your skills. Remember that trading is a marathon, not a sprint, and success comes with time and experience.